Danger!! If you are leading or working in a Project Portfolio Management Office (PMO) you are an endangered species!

Most Project Portfolio Management Offices (PMO) have a lifespan of around two years.[1] Beyond that time the PMO is liable to be disbanded or have the personnel replaced – either way, it can be a dangerous place career-wise to be.

If you are leading a PMO or undertaking a PMO role, you need to know where to focus and how to operate so as to clearly demonstrate the value you deliver to your organization so that you can preserve your role and, perhaps, your career.

The process of creating a PMO can play out a bit like Ground Hog Day

In many organizations, setting up a Portfolio Management function to seems to follow a very predicatable path.

- Senior management recognizes that they need to manage their large capital investments and large list of projects more effectively - as a portfolio - to ensure that the project investments align with strategy and deliver business value.

- A Portfolio Management Office is established to manage the project portfolio.

- A few years later, the Portfolio Management Office is disbanded as “an overhead”, “an unnecessary evil” or even “compliance police”, which is seen to not add value;

- Some time later senior management decide that they need to manage their large capital investments more effectively …

- And so the cycle repeats.

Why is this happening?

The orthodox view of Project Portfolio Management

Unfortunately, too often newly created PMO's set themselves up for the inevitable sad ending simply because much of the information, guidance and tools provided to support PMOs is either irrelevant, misfocused or just plain wrong.

The reason for that is because, they aredriven by a perpective created by and for project people.

It assumes that portfolio management is just about scaling-up the project delivery and cost management processes to be bigger and more complex - to cover the whole enterprise. It even uses the same structures, elements & dimensions at the portfolio level that are used at the project and program delivery levels.

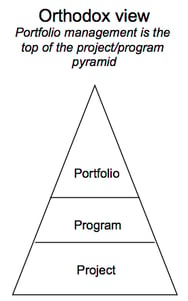

Project Portfolio Management is seen as a superset of projects and programs. Indeed, the common way this is represented is as pyramid diagram with projects at the bottom and portfolios at the top.

Project Portfolio Management is seen as a superset of projects and programs. Indeed, the common way this is represented is as pyramid diagram with projects at the bottom and portfolios at the top.

In this view, the role Portfolio Manager is seen as primarily as an administrative one, processing project reports or consolidating cash flows and resource needs or enforcing standard project delivery methodologies. The portfolio management function manages the execution of projects and the delivery of the project outcomes.

It is this orthodox view that not only adds zero value to the organization, but also actually destroys value (not to mention destroying careers). It is this view that gets portfolio management abolished.

Driven by this view of the Portfolio role, too often the first thing that a newly established PMO attempts, is to install software tools to track and automate all reporting for projects; or to bring in a standardized project delivery methodology. Or to manage and smooth resource availability to service the ever increasing pipeline of projects to be done.

Don't get the wrong idea here. We are not down playing the importance of getting your "project delivery" house in order. But that's not where the value is.

Tackling the creation and operation of a PMO in that manner demonstrates that the PMO leader doesn’t understand the PMO role sufficiently well. Hence the short life span.

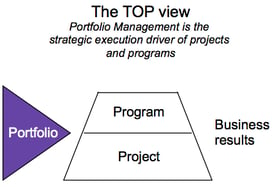

The Strategic Portfolio Management role

The PMO role is a strategic role. It manages the project investment portfolio to execute the agreed business strategy. The PMO should be seen therefore, as a subset of the Strategic Investment Committee, not as a superset of the project delivery function. The Portfolio Management function is a subset of strategy execution.

The PMO role is a strategic role. It manages the project investment portfolio to execute the agreed business strategy. The PMO should be seen therefore, as a subset of the Strategic Investment Committee, not as a superset of the project delivery function. The Portfolio Management function is a subset of strategy execution.

Now some of you will violently disagree with this strategic focus. Fine, Good luck. Stop reading now.

For the rest of you, let's talk in detail about the Strategic Portfolio Management role - the SPMO.

Portfolio Management ensures the portfolio of projects visibly contributes to and delivers the agreed strategy and optimizes and delivers the available business value and that the organization gets the returns on investments it expects.

Just as you don’t need to be a car mechanic to drive a car, you don't need to be a project manager to manage a portfolio. Sure, you need to understand the dynamics of projects, what can and does go wrong, what the leading indicators of failure are and how to optimize your projects.

But the primary critical success factor is the understanding of portfolio management as managing the interlinkages and interdependencies of a group of projects across the organization over time to deliver the strategy.

When does an organization need a SPMO?

How do you know if creating a Portfolio Management Office will add value to your organisation? Simply, it is when you determine that you need to manage your projects as a inter-related series of investments rather than as discrete ones. There are 12 main factors that determine this:

- The volume of projects allows conflicting projects to be unknowingly created and co-exist.

- The volatility of projects allows events and risks to ‘fall through the cracks’ between projects.

- The dynamics and changes to projects can cause cross project problems and value loss.

- The number of persons/entities involved in project delivery (including consultants and contractors) does not allow their availability and performance information to be readily known.

- A number of projects require access to (to share) rare/expensive specialized skills.

- There are dedicated expert resources, outside of other line structures who have to be centrally managed.

- The need for consistent project results requires a common set of approaches, methodologies, tools, standards to be developed, promulgated and managed.

- The value loss from a project (inability to meet expectations/planned results) is recognized as a problem to be dealt with.

- The volume of projects is such that no overall view is known.

- Projects decisions are made in isolation but draw on a common pool of resources, funds and impact the same business areas.

- Management needs/wants an overall view of ‘what’s happening’ and its future implications.

- Projects with complex interlinkages and interdependencies must be delivered over a number of years.

Establishing a Strategic PMO can be challenging

The challenge with the SPMO role is its breadth and the fact that it serves multiple masters.

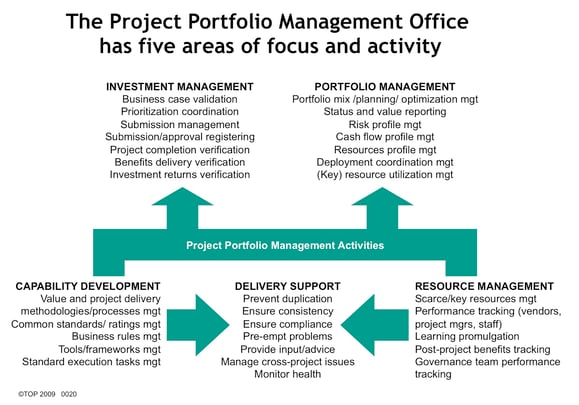

The SPMO has five key roles:

- two roles that support the Investment Committee - so that it can make the right investment decisions;

- Investment Management

- Portfolio Management - three roles supporting the Projects and Programs - so that they can deliver the strategy, value and returns expected.

- Capability Development

- Delivery Support

- Resource Management

Newly created PMOs can fall into the trap of focussing on the most obvious but least valuable activity in the portfolio management role - that of portfolio reporting - to the detriment of the far more important activities and roles - especially those which focus on the investment strategy and portfolio value delivery optimization.

Newly created PMOs can fall into the trap of focussing on the most obvious but least valuable activity in the portfolio management role - that of portfolio reporting - to the detriment of the far more important activities and roles - especially those which focus on the investment strategy and portfolio value delivery optimization.

Where should SPMOs focus to maximise the value?

The SPMO can maximise the value they add to the organization by focussing on these areas:

- Measure, manage and analyze your portfolio’s make-up, status and strategic contribution – is the strategy being fully delivered effectively, appropriately and delivering the desired results?

- Thoroughly validate planned investments before they are submitted for approval so as to optimize their value and prevent ‘set up to fail’ projects proceeding.

- Track and manage at the portfolio level common issues, risks and critical success factors so as to protect the overall value of the portfolio and reduce the workload on individual projects.

- Monitor, support and report the efficient delivery of the agreed business outcomes, benefits, value and strategy across your portfolio – quickly identifying when the desired results are at risk so as to take remedial action.

- Monitor and support effective project governance – ensuring they know their roles and both can and do perform them effectively during and after the end of the project.

- Track, support and report the realization of post-project benefits so as to ensure all of the available business value is realized as quickly as practical.

- Develop, enhance and support your organization’s value delivery tools, techniques and templates so as to equip the business and project teams with the “organizational capability” to successfully and consistently deliver the project results.

- Identify, develop and manage the key value delivery skills, competencies and resources so as to ensure the organization has the right skills in the right areas at the right time.

How can you tell if your SPMO is effective?

You need to think, track and measure ‘strategy and value delivery’ at the portfolio level. When you look at your existing portfolio, you should be 100% confident that:

- Each project visibly contributes to the agreed strategy in the right sequence and warrants investment

- Each project is set up from top to bottom to maximize and optimize its potential value

- Each project is being run to protect and deliver the promised value

- The resources – people, money, time – are being used effectively to minimize the cost of delivery

- The portfolio is performing – both formally through the reporting mechanisms and informally through the tracking of the leading indicators of failure

- The organization’s capability to deliver value from its project investments is increasing year-on-year

If you can’t answer ‘yes’ to these questions, then you are more likely administering your portfolio rather than managing it effectively.

Actions for improvement?

To shift from "adding up the costs" to "adding up the value there are a number of simple actions you can take.

1 Understand the Project Portfolio Management role is a strategic not a project role.

This is a very different perspective that generates different demands and uses different measures of success.

You can read our primer - Understanding portfolio management - which can give you a head start on what you need to do to ensure your SPMO is seen as successful by the business.

2 Ensure that all projects are scored for their contribution to strategy

All projects should be scored transparently and objectively on a scale for the nature and level of their strategic contribution. This is more than just a "tick the box" approach. Instead what you need is a clear scoring tool that links the strategic needs to a scoring tool that is applied to all projects in a standardized way. This ensures that proposals with a low strategic contribution which are essentially irrelevant are should not be funded unless there are other significant overriding reasons. It ensures that strategically important projects are funded and prioritised for action.

TOP's Strategic Contribution Assessment Tool ( ‘SAT’) can be used to develop a simple transparent scoring process that you can use to assess all proposals and projects. In addition this tool also equips you to analyze your portfolio to identify any strategies or strategic imperatives that are being over or under serviced.

You can read more about the Strategic Contribution Assessment Tool tool in this Thoughtleader

3 Manage your ‘value delivery capability’

A key contribution of the SPMO is to bring ‘value delivery’ thinking, tools and capability to project delivery and strategy execution. This is an area commonly neglected by even the ‘portfolio management standards’ as they have not been developed from a value delivery perspective. This is a key dimension for you to deliver that will increase both your portfolio and organization’s results.

4 Manage the pre-Business Case stage

Ensure all proposals and projects are strategically relevant, able to be successfully delivered by your organization and that you have the resources in place to successfully deliver them.

The development and application of the Strategic Contribution Assessment Tool can radically improve both the perception of the SPMO and the value of the portfolio.

5 Manage the Business Case stage

Ensure the prioritization process works to identify the highest priority investments. Put in place the measures and processes needed to ensure that every proposed investment is optimized to deliver the “best bang for the buck.”

The SPMO can radically increase the value of the portfolio through the effective management of the business case evaluation, validation, approval and prioritization processes. This is where millions in costs can be saved and millions gained in additional benefits.

6 Manage the portfolio’s delivery through project execution

Improve the execution quality of the projects/programs, track and measure the business results delivered and increase the organisational benefits generated from the portfolio’s projects/programs.

By increasing the speed of the end-to-end execution of projects, ideas can be translated into results faster and for lower cost.

The effective SPMO orchestrates the delivery of the portfolio to demonstrably improve the business’s performance and visibly deliver the strategy.

How TOP can help

TOP’s Portfolio Management Center of Expertise provides the tools, techniques and processes for those that not only want to survive in their Portfolio Management role but to move it to a true strategy execution focus.

Please contact us for help and further information.